10/12/2024

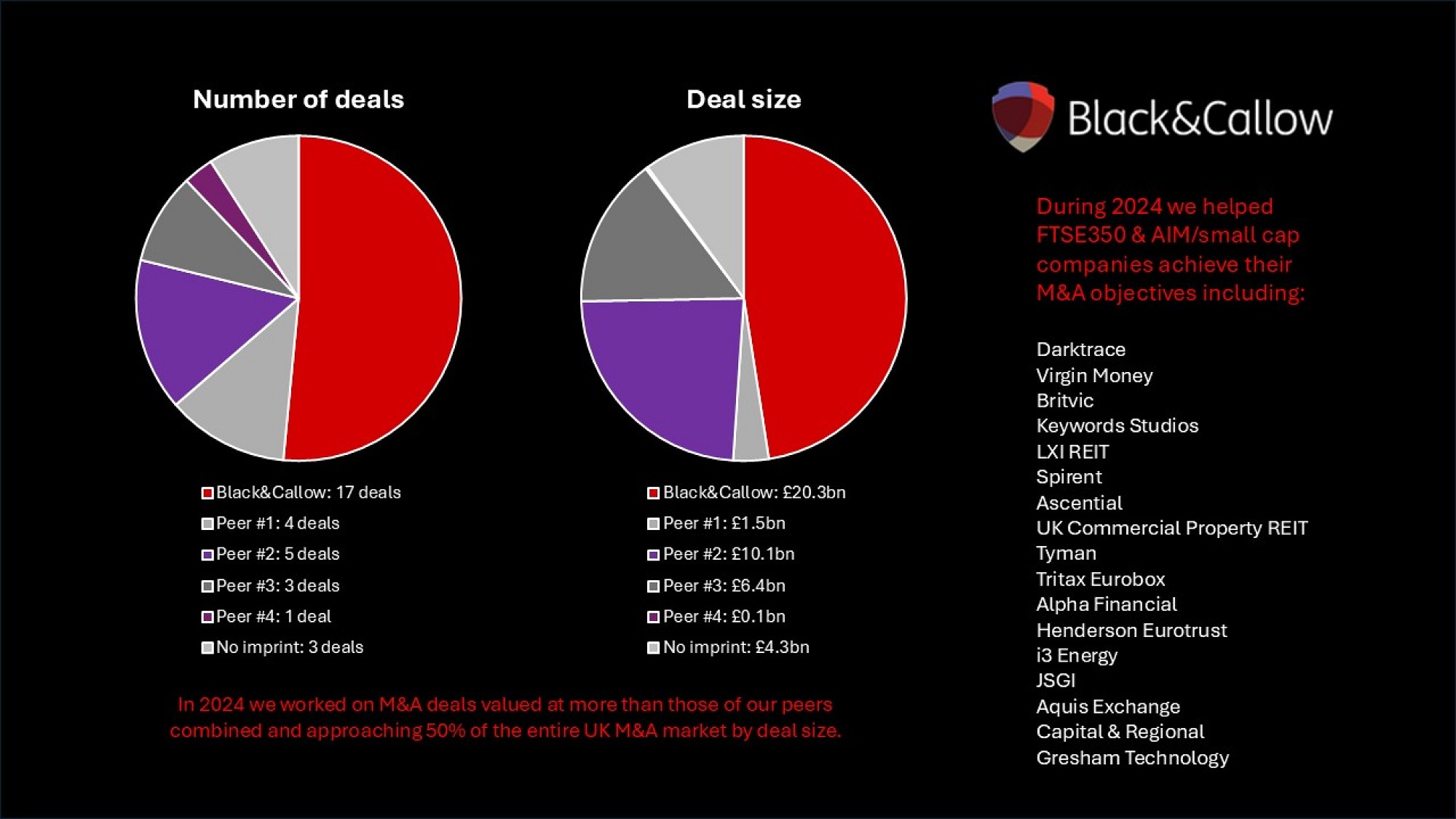

We're incredibly proud to have worked on more M&A deals in 2024 than our peers combined, according to data supplied by Peel Hunt to City AM.

B&C assisted with typesetting, printing and mailing for 17 of the 33 top takeovers for which documentation was sent to shareholders this year, including multibillion-pound cross-border deals such as US private equity firm Thoma Bravo’s £4.3bn takeover of cybersecurity company Darktrace as well as Nationwide’s £2.8bn purchase of Virgin Money.

Dan Coatsworth, investment analyst at AJ Bell, noted in City AM's article that M&A activity is “red hot” as listed companies seek to generate an uplift for shareholders. “So many UK-listed companies are being taken over because the market didn’t spot the value on offer,” he added.

Among the biggest premiums this year was the takeover of FTSE 250 telecoms firm Spirent Communications, which struck a £1.2bn deal with US electronic equipment maker Keysight at a premium of 86% and video game developer Keywords Studios take-private by private equity firm EQT for £2bn at a 67% premium: both deals on which B&C worked.

* * *

As well as by number, the value of the completed deals on which the B&C team worked approached the combined value of our peers' deals, at over £10bn.

And our assistance was not relegated to FTSE 350: we helped equally with AIM and small cap deals for leading law firms, investment banks, corporates and PE firms, to whom we give our heartfelt thanks for their faith in appointing us.

"For many clients, it's the speed of turnaround around the clock, as well as reliability and accuracy, which are key factors in appointing us," said Tim Black, Joint MD at B&C. "With our unrivalled in-house financial typesetting, the largest of its kind in Europe, we're in a unique position to help clients when they most need it."

Chris Callow, Joint MD at B&C, added: "Not only that, but 24/7 project management by the most experienced team in Europe, as well as our unique in-house production and mailing, mean that we can give our clients greater flexibility than our peers - especially important at the crucial stages of an M&A deal."

If you'd like to find out how we can help ensure the success of your most prestigious M&A deals, chat with us today: hello@blackandcallow.com

Other recent news

31/03/2025

Power rangers: helping Elia Group with its €1.35bn Rights Offeri…

26/03/2025

Mastering the IPO journey: join the LSE's webinar on Thursday 17…

18/03/2025

B&C assists Britsh Columbia's £1bn bid for BBGI Global Infastruc…

06/03/2025